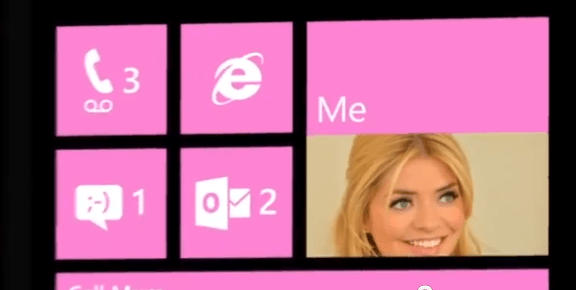

WP8 TV Advert Starring Holly Willoughby

Advertisements

The latest celebrity endorsement for WP besides the beautiful Jessica Alba is a star more popular in the UK (personally never heard of her, but a quick Google & IMDB cleared that up); the ad is simple clean and slightly “funny” in a cute way. Touching up on Kids Corner, Me Tiles, Live Tiles and WP in general, not too shabby. Plus it’s all shown on a Lumia 920 (Ad is obviously by Microsoft and not Nokia).

http://www.youtube.com/watch?feature=player_embedded&v=vD1Uxvl84bg

Advertisements

Category: Lumia, Nokia, Video, Windows Phone

Connect

Connect with us on the following social media platforms.