Analyst & Banks Buying Shares in Nokia, Despite Warning Others Not to Invest

It seems that the so-called Investment advisers and banks can’t make up their minds, although most credit companies have rated Nokia’s stock at “junk” or at best “don’t buy” that doesn’t seem to have stopped them from making a move themselves. I’ve watched enough “Shark Tank” to know that it’s not uncommon to feign disinterest in a product/company just to get a better deal for yourself, and it seems that might be exactly what’s been going on.

Some of the largest names in financials and banking have increased their stakes in Nokia in surprising amounts:

In the face of extremely negative sentiment, two investment banks, namely Morgan Stanley (MS) and Goldman Sachs (GS), increased the number of Nokia shares they were holding in the last quarter. In the beginning of last quarter, Goldman Sachs held 61 million shares of Nokia. As of the end of the last quarter, the investment bank holds 116 million shares of the company. This indicates an increase of nearly 90%. As for Morgan Stanley, the bank held 4 million shares of the company in the beginning of the quarter, whereas, it ended up holding 32 million shares by the end of the quarter. This is an increase of nearly 700%.

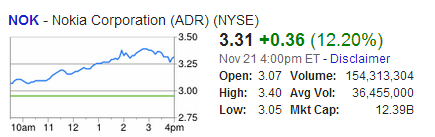

Seems like an awkward decision to increase your stakes so much in a “Junk” company; on the other hand today Nokia’s stock broke the 3 dollar mark, which it has been flirting with for the past two months or so, closing at a respectable 12% increase for $3.31 a share. Are things starting to look up or is this just a passing trend? Fingers crossed for the former.

Via thanks for the tip viktor von d.

Category: Lumia, Nokia, Windows Phone

Connect

Connect with us on the following social media platforms.